- Developer

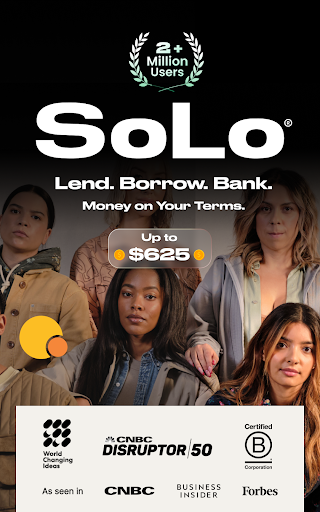

- Solo Funds

- Version

- 2.10.8

- Content Rating

- Everyone

- Installs

- 0.50M

- Price

- Free

- Ratings

- 4.2

Core Features

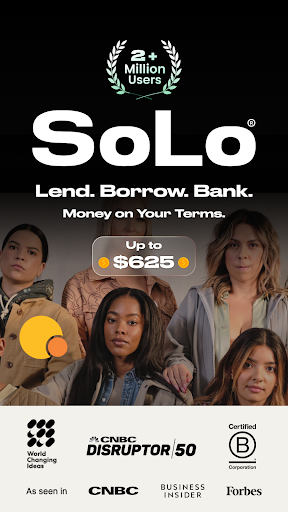

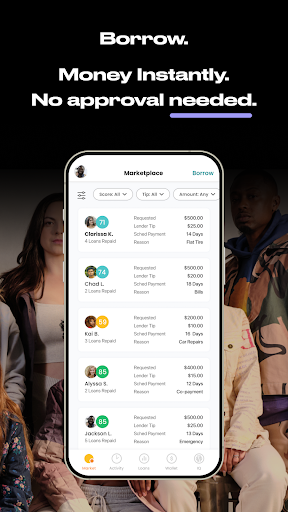

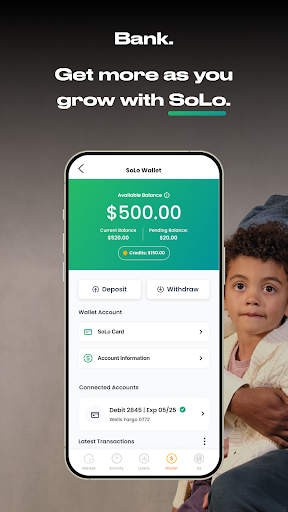

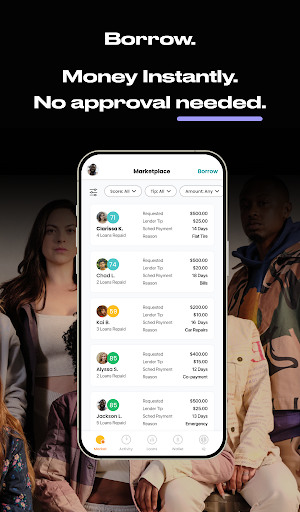

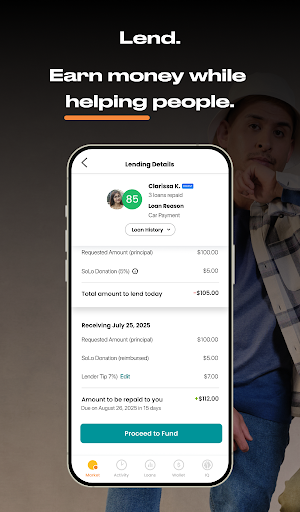

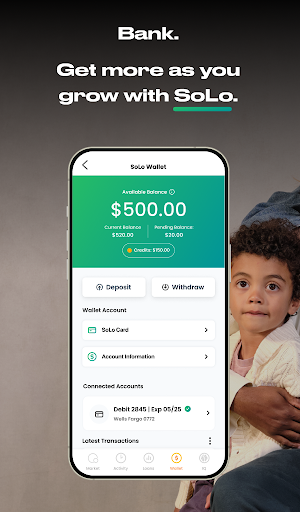

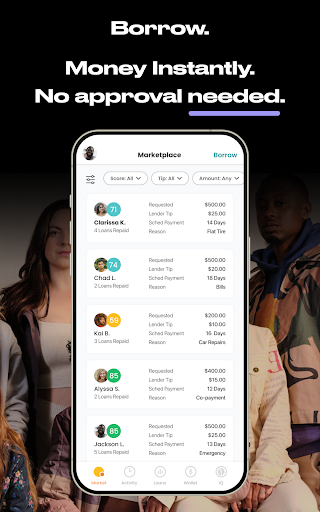

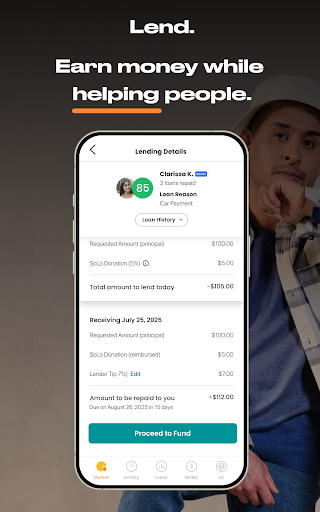

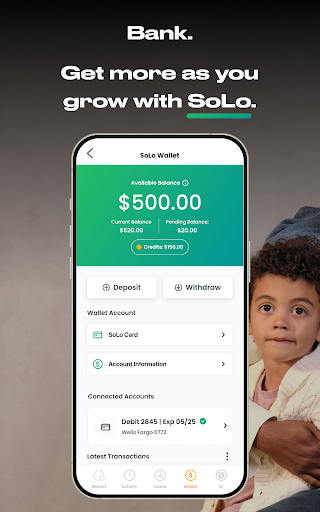

- The app provides secure and user-friendly methods for lending and borrowing money, making transactions simple.

- App features include real-time updates on loan statuses, ensuring users stay informed throughout the process.

- It offers an intuitive interface designed to enhance the app experience for both lenders and borrowers.

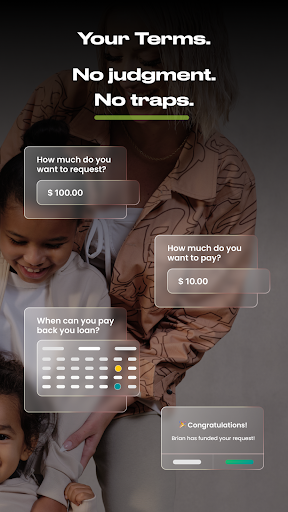

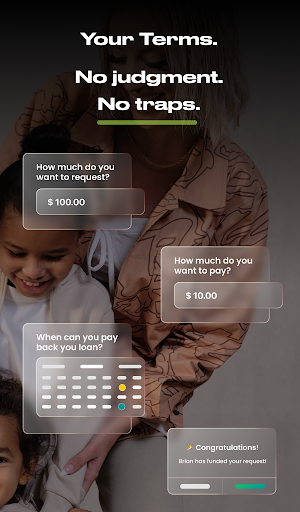

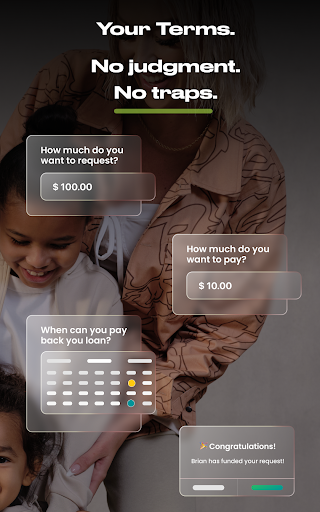

- With flexible repayment options, the app helps users manage their finances more effectively.

- This mobile app includes in-app messaging, allowing seamless communication between parties.

- Integrated credit-building features enable users to improve their financial standing over time.

- The app supports verification processes to foster trust and ensure security for all transactions.

Who This App Is For

This target audience includes adults aged 18 and above who need quick access to personal loans or wish to lend money within their community. It's ideal for individuals seeking an app-based solution for short-term financial needs.

Whether you're managing emergencies or looking to assist friends, this mobile app offers a reliable platform for various financial scenarios, enhancing your app experience and providing a safe environment for both lenders and borrowers.

Why Choose This App

This Android app delivers a trusted and efficient way to handle peer-to-peer lending with a focus on security and ease of use. Its app features are designed to meet user needs and simplify the lending process.

It stands out among alternatives by offering a straightforward app experience with comprehensive features that address common financial challenges, making it a preferred app-based solution for personal finance management.

SoLo Funds: Lend & Borrow

Finance 4.2Ratings:

Downloads:

Age:

Pros

- Easy-to-use interface

- Fast approval process

- Competitive interest rates

- Robust borrower screening

- Transparent fee structure

Cons

- Limited borrower eligibility criteria (impact: Medium)

- Interest rate fluctuations (impact: Low)

- Limited geographic availability (impact: Medium)

- Customer support response time (impact: Low)

- Lack of financial education resources (impact: Low)

Frequently Asked Questions

How do I log into the SoLo Funds: Lend & Borrow app?

To access the SoLo Funds mobile app, you need to create an account using your email address or social media profiles. Once registered, logging in is quick and straightforward, giving you instant access to its app features. The app provides a secure login process, ensuring your personal information stays protected. If you forget your password, there's an easy recovery option to regain access without hassle. This experience aims to make borrowing and lending as smooth as possible.

Is the SoLo Funds app safe to use?

Yes, the SoLo Funds app is designed with user safety as a top priority. It uses encryption and other security measures to protect your personal and financial information. As a trusted app-based solution in the finance category, it complies with industry standards. You can feel confident that your data stays private while enjoying the convenience of the Android app. Always ensure you're downloading from official sources to maintain security and trust in your app experience.

What features does the SoLo Funds app offer?

The SoLo Funds app provides a variety of app features that facilitate easy borrowing and lending within your community. You can request funds, lend money, and track your transactions all from a user-friendly interface. This finance-focused app also offers real-time updates, secure payment options, and clear loan terms, making it a reliable app experience for anyone seeking an app based solution for personal finance needs in a simple way.

Can I use the SoLo Funds app on my Android device?

Absolutely! The SoLo Funds app is fully compatible with Android devices, making it accessible to a wide range of users. Its mobile app version offers all key features needed for managing loans easily. Since it operates as an Android app, you can enjoy a seamless app experience that is optimized for your device. Whether you're at home or on the go, this app based solution is designed to meet your financial needs conveniently.

Are there any costs or fees for using the SoLo Funds app?

The app features transparent fee structures, which are clearly outlined before you engage in any transaction. Usually, there are minimal costs related to loan processing or administrative fees. Understanding these app features helps you make informed decisions about borrowing or lending money, ensuring your app experience remains trustworthy and straightforward.

How do I ensure my transactions are secure using the app?

The SoLo Funds app employs advanced encryption and security protocols to safeguard all transactions. Rest assured, your sensitive information is protected during every step of the borrowing or lending process. As a reputable app-based solution, it maintains strict standards to keep users safe. Always use a secured internet connection and follow recommended security practices for the best app experience.

Is the SoLo Funds app suitable for first-time users?

Yes, the app features an intuitive interface designed with simplicity in mind, making it easy even for first-timers to navigate. The app experience includes helpful guides, making the borrowing and lending process hassle-free. As part of its app features, it offers step-by-step instructions and customer support options, ensuring new users can quickly get comfortable with the app and enjoy its benefits confidently.

What should I do if I encounter problems with the app?

If you experience issues, the first step is to consult the FAQ section or use the support options within the app. The customer service team is knowledgeable and ready to assist with any technical or account-related questions. Being a trusted app-based solution, SoLo Funds prioritizes user satisfaction and actively resolves problems to enhance the app experience for all users.

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Capital One Mobile

Finance 4.5

TrueMoney

Finance 3.4

Revolut: Spend, Save, Trade

Finance 4.7

Intuit Credit Karma

Finance 4.8

Venmo

Finance 4.9

Investing.com: Stock Market

Finance 4.6

Green Dot - Mobile Banking

Finance 3.6

Uphold: Buy BTC, ETH and 300+

Finance 4.5

Albert: Budgeting and Banking

Finance 4.6