- Developer

- NetSpend

- Version

- 7.0.4

- Content Rating

- Everyone

- Installs

- 5.00M

- Price

- Free

- Ratings

- 4.6

Core Features

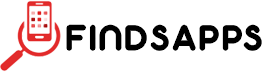

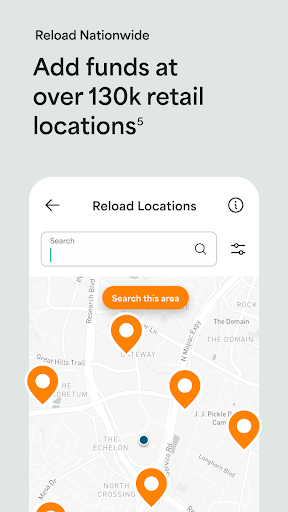

- The app features a user-friendly interface that simplifies managing finances on your mobile device.

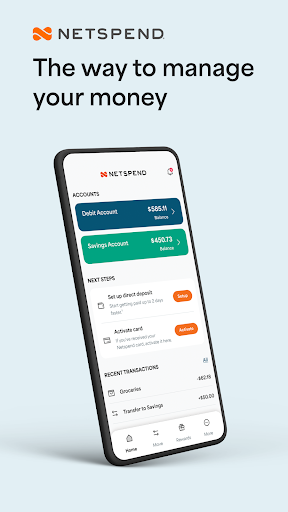

- Real-time transaction sync ensures updates are instantly reflected across all your devices, providing reliable app experience.

- Advanced security measures protect your personal and financial information, building trust and confidence in the app-based solution.

- It includes budget tracking tools that help users monitor expenses and plan savings effortlessly.

- The app offers expense categorization, making it easier to analyze spending habits over time.

- With offline mode support, users can access their financial details even without an internet connection.

- The launcher app feature allows quick access to your financial dashboard directly from your Android device home screen.

Who This App Is For

This mobile app is ideal for individuals aged 18-45 who want a simple, secure way to manage their finances on Android devices. It's perfect for tech-savvy users seeking an intuitive app experience for everyday money tasks.

Whether you're a busy professional, student, or someone looking for an app-based solution to track expenses and budget, this app helps streamline your financial management in real-life scenarios, offering convenience and control at your fingertips.

Why Choose This App

This Android app stands out thanks to its seamless app features that deliver a smooth, trustworthy experience. It offers a comprehensive app experience that simplifies financial management for everyday users.

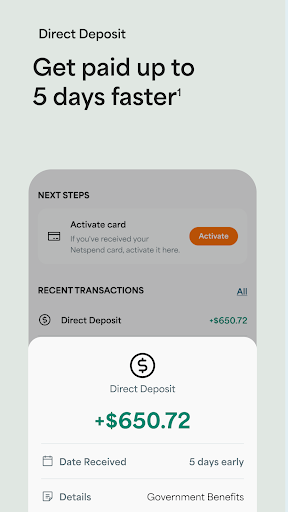

By focusing on security, real-time updates, and offline capabilities, this app provides solutions to common financial tracking problems, making it a reliable choice among many similar apps in the finance category.

Classic Netspend

Finance 4.6Ratings:

Downloads:

Age:

Pros

- User-friendly Interface

- No Monthly Fees

- Wide Acceptance

- Mobile Check Deposit

- Expense Tracking

Cons

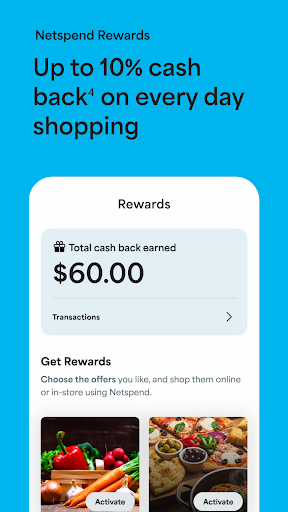

- Limited Rewards Program (impact: Low)

- Customer Support Availability (impact: Medium)

- Transaction Restrictions (impact: Medium)

- Account Management Features (impact: Low)

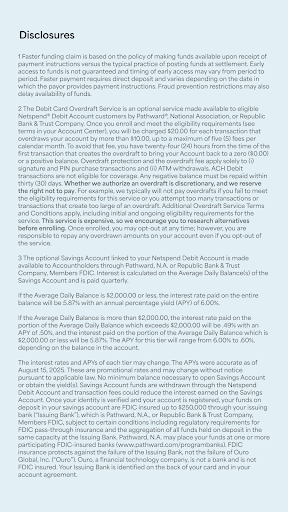

- Fees for Certain Services (impact: High)

Frequently Asked Questions

How do I log into the Classic Netspend mobile app?

To access your account on the Classic Netspend mobile app, you need to enter your username and password after installing the app. The login process is straightforward and designed to provide quick access to your financial information. If you're having trouble logging in, make sure your app is updated, and your internet connection is stable. The app experience is built for ease of use, whether you're on an Android device or another platform.

Is the Classic Netspend app safe to use?

Yes, the Classic Netspend mobile app is designed with security in mind, utilizing encryption to protect your personal information. As a reputable app based solution, it follows industry standards to ensure your data remains secure during transactions. Always download the app from official sources like the Google Play Store to avoid malicious versions. Trust in the app's security features helps you manage your finances confidently.

Can I use the Classic Netspend app on an Android device?

Absolutely, the Classic Netspend mobile app is available for Android app users. It offers a seamless app experience optimized for Android devices, making managing your prepaid card simple and convenient. Whether you're checking your balance or making transactions, the app features are tailored for easy navigation on any Android-powered launcher app, providing quick access to your financial data wherever you are.

What features does the Classic Netspend app offer?

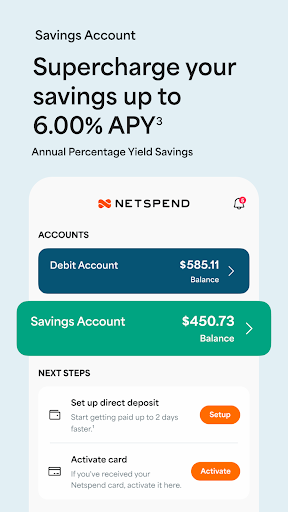

The app features include real-time account monitoring, fund transfers, and direct deposit setup. It also allows you to load funds easily and manage your account settings within a user-friendly interface. With these app features, you get a comprehensive app based solution that enhances your financial management. The app experience is designed to make banking and money management straightforward and efficient.

Does the Classic Netspend app support multiple account types?

Yes, the app supports managing multiple accounts if you have more than one prepaid card with Netspend. This makes it easier to keep track of various funds separately within the same app experience. Managing multiple accounts on a single mobile app reduces the need for switching between different platforms, offering a consolidated view of your finances. This feature reflects the app's focus on providing a versatile and user-centric app experience.

What should I do if I forget my password for the app?

If you forget your password, the app provides a straightforward reset process. You can initiate the password recovery through the login screen by verifying your identity with your registered email or phone number. Resetting your password helps you regain access to your account securely. The app's safety protocols ensure your account remains protected during this process.

Are there any updates or new versions of the Classic Netspend app?

Yes, the developers regularly update the app to enhance features, security, and overall app experience. Keeping your app up-to-date ensures you benefit from the latest improvements and safer transactions. Updates typically include bug fixes and new app features designed to better serve your financial needs within the app based solution framework your account relies on.

How do I contact customer support for the Classic Netspend app?

Customer support can be reached through the app's help section or directly on the official Netspend website. They provide assistance for issues related to login, transactions, or app functionality. Reliable support ensures you can resolve problems quickly, maintaining trust and confidence in your app experience with Classic Netspend.

Venmo

Finance 4.9

Investing.com: Stock Market

Finance 4.6

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Capital One Mobile

Finance 4.5

TrueMoney

Finance 3.4

Revolut: Spend, Save, Trade

Finance 4.7

Intuit Credit Karma

Finance 4.8

Credit Sesame: Grow your score

Finance 4.7

MoneyLion: Bank & Earn Rewards

Finance 4.6

Green Dot - Mobile Banking

Finance 3.6