- Developer

- Varo Bank, N.A.

- Version

- 4.21.2

- Content Rating

- Everyone

- Installs

- 5.00M

- Price

- Free

- Ratings

- 4.9

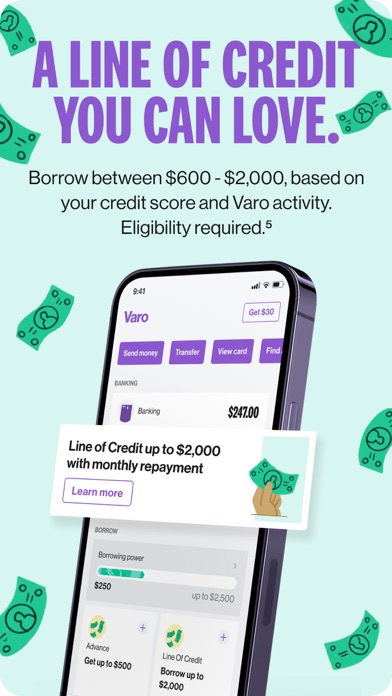

Core Features

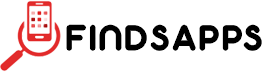

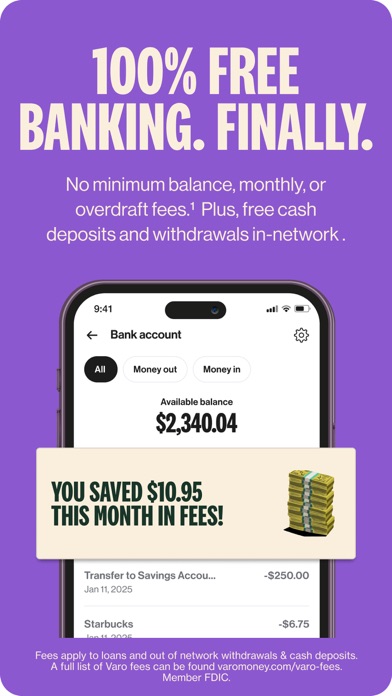

- The app features secure, quick mobile banking with real-time transaction updates for a smooth app experience.

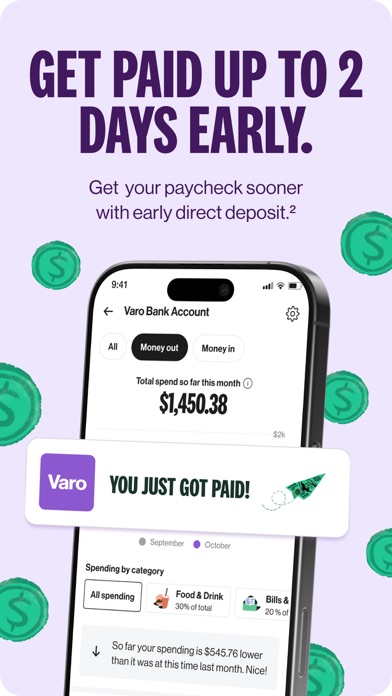

- It offers robust account management tools, including balance checks, fund transfers, and bill payments easily accessible within the app.

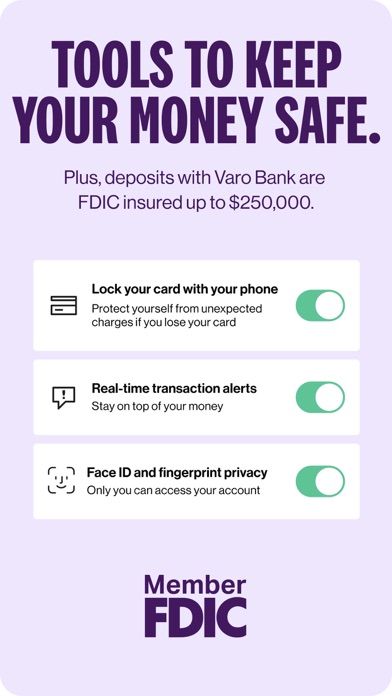

- With biometric login support, users can access their accounts securely and conveniently on their Android app or other devices.

- The app includes budget tracking features that help users monitor expenses and plan finances effectively.

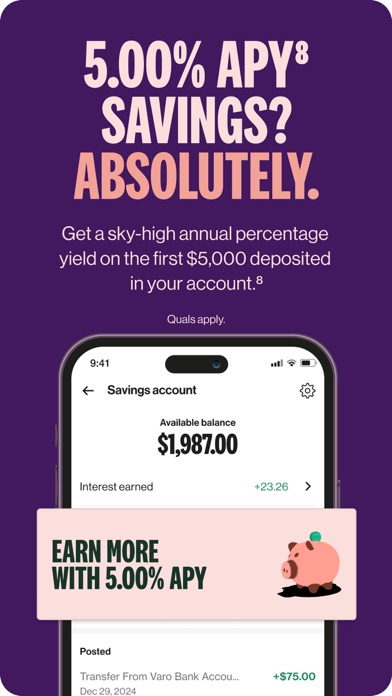

- Customers can set up and manage savings goals directly through the app, enhancing financial planning.

- App features include instant notifications for transactions and account activities, ensuring users stay informed.

- This mobile app provides a seamless user interface optimized for both phones and tablets, enhancing the overall app experience.

Who This App Is For

This app-based solution is ideal for individuals aged 18-50 who prefer managing their finances digitally. It's perfect for tech-savvy users seeking a straightforward mobile banking experience.

Whether you're looking to handle daily transactions, track expenses, or set savings goals, this Android app simplifies your financial routines. It's suited for anyone wanting secure, reliable online banking from their mobile device.

Why Choose This App

This app stands out because it combines user-friendly features with strong security, creating an excellent app experience for bank customers. Its app features are designed to address common banking needs efficiently.

Choosing this Android app means opting for an app-based solution that provides convenience, safety, and comprehensive financial control, making it a reliable choice over other banking apps.

Varo Bank: Online Banking

Finance 4.9Ratings:

Downloads:

Age:

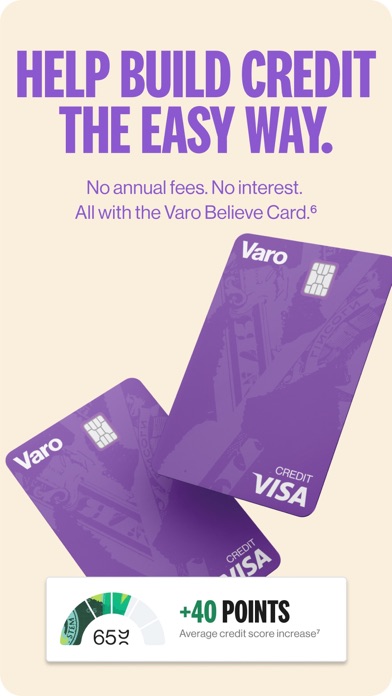

Pros

- User-friendly interface

- Fast and seamless transactions

- Advanced security features

- No monthly maintenance fees

- Early direct deposit feature

Cons

- Limited ATM network (impact: medium)

- Inconsistent customer service response times (impact: medium)

- Features occasionally experience bugs or glitches (impact: low)

- Limited product offerings compared to traditional banks (impact: low)

- Mobile deposit checks can sometimes be rejected due to photo quality (impact: low)

Frequently Asked Questions

How do I sign up and log in to the Varo Bank mobile app?

Getting started with the Varo Bank mobile app is straightforward. You simply need to download the app from your device's app store and follow the registration prompts. The app provides an intuitive interface to help new users create an account quickly.

Logging in is easy once you've registered. Just enter your username and password, and you'll gain access to your account securely. The app's experience is designed to be seamless and user-friendly, making managing your finances convenient from anywhere.

Is the Varo Bank app safe to use on my Android device?

Yes, the Varo Bank Android app adheres to strict security standards to protect your personal and financial information. It uses encryption and multi-factor authentication to ensure your data remains confidential and safe from unauthorized access.

As an app based solution, Varo prioritizes safety and trustworthiness. Always keep your app updated to benefit from the latest security features and enhancements, ensuring a reliable app experience every time you log in.

Can I fund and manage multiple bank accounts using this app?

Absolutely. The Varo Bank mobile app allows you to link and manage multiple accounts conveniently. Its app features include transferring funds, checking balances, and setting up alerts, all designed to give you full control over your finances.

This app based solution simplifies your financial management, making it easier to handle different accounts without needing to visit a branch or use multiple banking sites. The user experience aims to be smooth for both new and experienced users alike.

Are there any limitations on the app's features or functionality?

The Varo Bank app offers a comprehensive suite of features, including mobile deposit, automatic savings, and expense tracking. However, certain features might be limited based on your account type or regional restrictions.

Despite these limitations, the app provides an excellent app experience by focusing on core banking needs, ensuring users can perform essential transactions securely and efficiently on their Android app or iOS devices.

How do I update or troubleshoot the app if I encounter issues?

If you experience problems with the Varo Bank mobile app, first ensure you are using the latest version available from your app store. Updates often include bug fixes and new features that improve the app experience.

For troubleshooting, restarting your device or reinstalling the app can resolve common issues. Varo provides helpful support resources within the app and on their website, giving you a reliable app based solution for any technical challenges.

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Capital One Mobile

Finance 4.5

TrueMoney

Finance 3.4

Revolut: Spend, Save, Trade

Finance 4.7

Intuit Credit Karma

Finance 4.8

Venmo

Finance 4.9

Investing.com: Stock Market

Finance 4.6

Green Dot - Mobile Banking

Finance 3.6

Uphold: Buy BTC, ETH and 300+

Finance 4.5

Albert: Budgeting and Banking

Finance 4.6