- Developer

- U.S. Bank Mobile

- Version

- 3.73.123

- Content Rating

- Everyone

- Installs

- 10.00M

- Price

- Free

- Ratings

- 4.7

Core Features

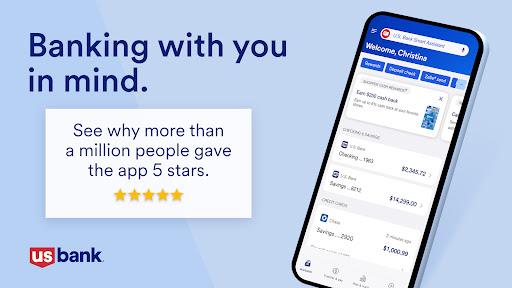

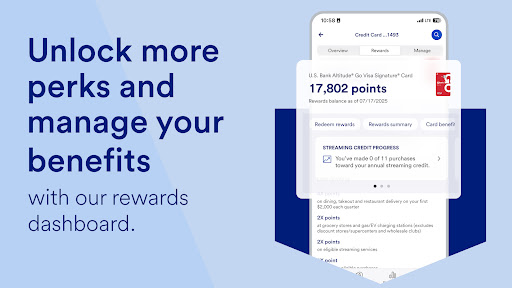

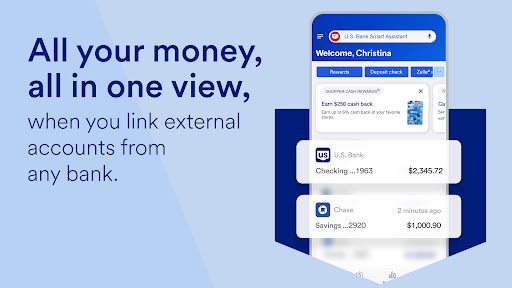

- The app features a sleek, user-friendly interface that makes managing your accounts simple and quick.

- Real-time transaction sync ensures your financial data is always up-to-date and accurate across devices.

- Secure login options, including biometric authentication, protect your sensitive banking information effectively.

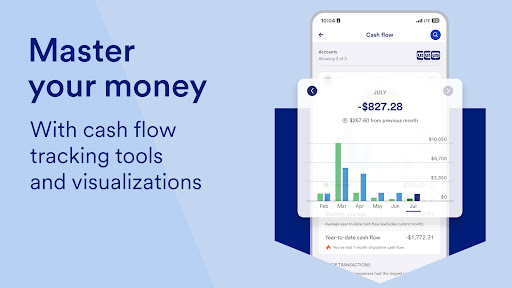

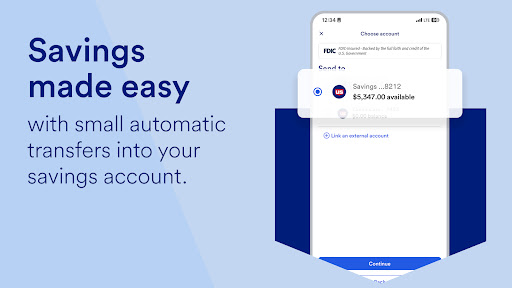

- You can easily transfer funds, pay bills, and set up alerts all within the app experience.

- Offline mode allows access to account balances and recent transactions even without an internet connection.

- The app includes a built-in launcher app that organizes banking functions for quick access and improved navigation.

- Push notifications keep you informed about account activity and important updates from your financial institution.

Who This App Is For

This mobile app is ideal for individuals who want a reliable app-based solution for managing their finances conveniently from their smartphones. It's perfect for busy professionals, students, and anyone seeking quick access to banking features on their Android app or iOS device.

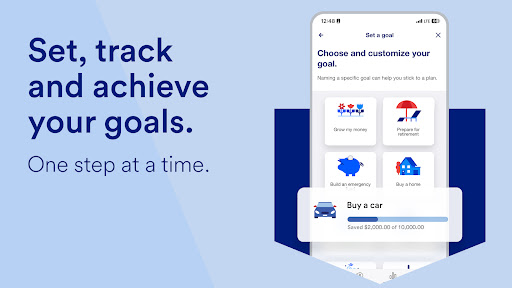

Whether you're tracking expenses, making transfers, or monitoring your savings, this app experience is designed to fit into everyday scenarios, helping you stay connected to your finances anytime, anywhere. It's suitable for users who prefer a straightforward, trustworthy mobile banking solution.

Why Choose This App

This Android app offers a comprehensive set of app features that enhance your banking experience with convenience and security. Its seamless app experience sets it apart from other solutions, making daily banking easier and more efficient.

By delivering a reliable and secure app-based solution, it solves common banking challenges such as accessing your account offline or managing transactions on the go. Its focus on user trust and functional ease makes it a top choice for personal finance management.

U.S. Bank Mobile Banking

Finance 4.7Ratings:

Downloads:

Age:

Pros

- User-Friendly Interface

- Robust Security Features

- Comprehensive Banking Services

- Real-Time Notifications

- Excellent Customer Support Integration

Cons

- Occasional App Crashes (impact: medium)

- Limited Budgeting Tools (impact: low)

- Slow Loading Times (impact: low)

- Some Features Not Available on All Devices (impact: low)

- Occasional Login Issues (impact: medium)

Frequently Asked Questions

Is the U.S. Bank Mobile Banking app safe to use?

Yes, the U.S. Bank Mobile Banking app is designed with security in mind. It uses encryption and multi-factor authentication to protect your personal and financial information, making it a trustworthy app for managing your accounts digitally. The app features include secure login processes and regular security updates, reflecting U.S. Bank's commitment to user safety. Always keep your device's OS and the app itself up to date for the best security practices.

How do I log in to the U.S. Bank Mobile Banking app?

To access the app experience, you need to use your U.S. Bank online banking credentials. If you're a new user, you can register directly within the app or on the bank's official website. The app is designed for easy navigation on both Android and iOS devices, and it offers features like fingerprint or facial recognition to make logging in quick and secure.

Can I use the U.S. Bank Mobile Banking app offline?

While the app features include real-time balance updates and transaction history, most functions require an active internet connection. For other tasks, such as viewing recent transactions, you might be able to access some information offline. For a seamless app experience, ensure you have a stable data connection. This app-based solution is optimized to work efficiently on standard network connections, although some features depend on online connectivity.

Is the U.S. Bank Mobile Banking app compatible with my device?

The app is available as an Android app and is compatible with most recent Android devices and versions. It also supports iOS devices, ensuring a broad user base can access its features. If your device supports the latest app updates, you should find the app works smoothly, providing an intuitive app experience for managing your finances on the go.

What are the main app features of U.S. Bank Mobile Banking?

The app features include mobile check deposit, bill pay, account transfers, and real-time balance viewing. Plus, you can set up alerts and access financial tools that help you stay on top of your finances easily. These features make the app a comprehensive app-based solution, designed to help you manage your banking needs conveniently from your phone.

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Capital One Mobile

Finance 4.5

TrueMoney

Finance 3.4

Revolut: Spend, Save, Trade

Finance 4.7

Intuit Credit Karma

Finance 4.8

Venmo

Finance 4.9

Investing.com: Stock Market

Finance 4.6

Green Dot - Mobile Banking

Finance 3.6

Uphold: Buy BTC, ETH and 300+

Finance 4.5

Albert: Budgeting and Banking

Finance 4.6