- Developer

- Phantom Technologies, Inc.

- Version

- 25.46.1

- Content Rating

- Everyone

- Installs

- 10.00M

- Price

- Free

- Ratings

- 4.8

Core Features

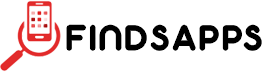

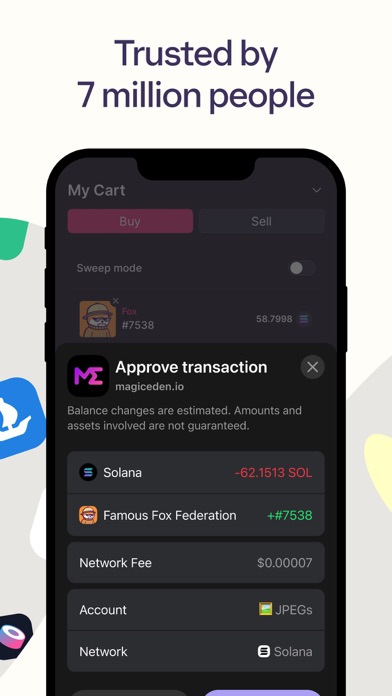

- The app features include real-time transaction sync, helping users stay updated instantly across devices.

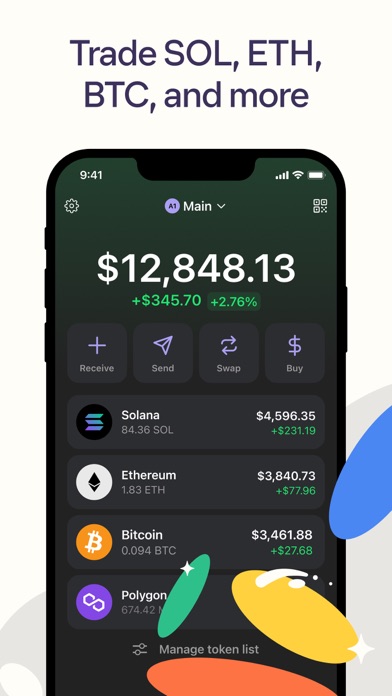

- Robust security protocols protect financial data, ensuring a trustworthy app experience for users.

- Intuitive interface allows easy navigation through various app features, making financial management simple.

- Customizable notifications alert users about important account activities and deadlines.

- Supports offline mode for access to certain features without an internet connection.

- Built-in budgeting tools assist in tracking expenses and managing personal finance efficiently.

- The app functions as a reliable launcher app for quick access to financial tools and resources.

Who This App Is For

This mobile app is ideal for adults aged 18-45 who want a straightforward way to manage their finances on their Android app. It's perfect for users seeking a secure, user-friendly app experience.

Whether you're looking to track expenses, plan savings, or stay updated on your financial status, this app-based solution caters to busy professionals and students alike, offering convenience in daily financial tasks.

Why Choose This App

This Android app stands out because of its comprehensive app features that simplify financial management and improve app experience. Its focus on security and usability makes it a trusted choice for managing personal finances.

Designed as an efficient app-based solution, it helps users solve common financial challenges with ease, offering a seamless experience compared to many other apps in the finance category.

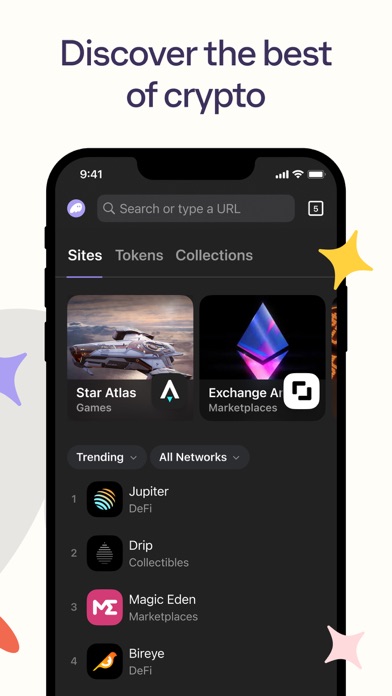

Phantom

Finance 4.8Ratings:

Downloads:

Age:

Pros

- Strong Privacy Protection

- User-Friendly Interface

- Fast Performance

- Reliable Connectivity

- Customizable Settings

Cons

- Limited Device Compatibility (impact: medium)

- Occasional App Crashes (impact: low)

- Premium Features Behind Paywall (impact: medium)

- Limited Customer Support Options (impact: low)

- Some Regional Restrictions (impact: medium)

Frequently Asked Questions

Is the Phantom app easy to use for new users?

Yes, Phantom is designed with user friendliness in mind, making it easy for new users to navigate through its features. The app experience is straightforward, helping you manage your finances without any hassle.

Its intuitive interface and clear layout ensure that even those unfamiliar with finance apps can quickly get started. As a trusted mobile app, Phantom offers an enjoyable and accessible experience for all users.

How secure is the Phantom finance app?

Security is a top priority for Phantom as a reliable app based solution. The app uses industry-standard encryption and security measures to protect your personal and financial data.

Consumers can feel confident that their information is safe when using this Android app. Regular updates and security features make Phantom a trustworthy choice for managing your finances securely.

What features does the Phantom finance app offer?

Phantom provides a range of app features that help you stay on top of your finances. These include budget tracking, expense categorization, and real-time account synchronization. It can also serve as a launcher app for quick access to financial tools.

Designed to optimize your app experience, the feature set makes managing money simpler and more efficient, giving you better control over your financial life.

Can I use Phantom on both Android and iOS devices?

Absolutely. Phantom is available as a mobile app for both Android and iOS platforms. Whether you prefer an Android app or an Apple device, you can enjoy its features seamlessly across different devices.

This cross-platform compatibility ensures you get a consistent app experience, making it easier to stay connected to your finances wherever you go.

Is Phantom suitable for long-term financial planning?

Yes, Phantom offers tools that support long-term financial planning. Its app features allow you to set goals, track progress, and analyze spending patterns over time.

As a trusted app based solution, it helps you develop better financial habits and make informed decisions, greatly enhancing your overall app experience in managing your money.

Venmo

Finance 4.9

Investing.com: Stock Market

Finance 4.6

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Capital One Mobile

Finance 4.5

TrueMoney

Finance 3.4

Revolut: Spend, Save, Trade

Finance 4.7

Intuit Credit Karma

Finance 4.8

Credit Sesame: Grow your score

Finance 4.7

MoneyLion: Bank & Earn Rewards

Finance 4.6

Green Dot - Mobile Banking

Finance 3.6