- Developer

- ONE Finance, Inc.

- Version

- 10.109.1

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.8

Core Features

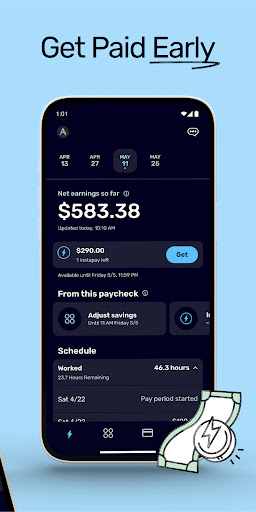

- The app features a user-friendly interface that simplifies managing your finances effectively.

- Real-time sync across devices ensures your financial data is always up-to-date and accessible.

- Offline mode allows access and editing of your financial information without an internet connection.

- Intuitive budget tracking tools help users set goals and monitor spending effortlessly.

- The app offers secure encryption, ensuring your sensitive financial data stays protected and trustworthy.

- Personalized notifications alert users about bill payments and budget limits for better financial control.

- Seamless integration with bank accounts and payment services enhances your overall app experience.

Who This App Is For

This app is ideal for individuals aged 18 and above who want a reliable app-based solution for personal finance management.

It benefits users seeking an Android app that offers comprehensive app features like budgeting and expense tracking, especially those who prefer an easy-to-use, trustworthy mobile app for daily financial tasks.

Why Choose This App

This Android app stands out with its robust app features, combining simplicity with powerful tools to manage finances efficiently.

Its seamless app experience and secure app-based solution make it a top choice for anyone looking for a trustworthy finance app that adapts to their needs and helps improve financial health.

ONE@Work (formerly Even)

Finance 4.8Ratings:

Downloads:

Age:

Pros

- User-Friendly Interface

- Comprehensive Workspace Management

- Smooth Collaboration Features

- Cross-Platform Compatibility

- Secure Data Protection

Cons

- Occasional Synchronization Delays (impact: medium)

- Limited Third-Party Integrations (impact: low)

- Learning Curve for Advanced Features (impact: low)

- Notification Management Slightly Clunky (impact: low)

- Offline Mode Limited in Functionality (impact: medium)

Frequently Asked Questions

What is the main purpose of the ONE@Work app?

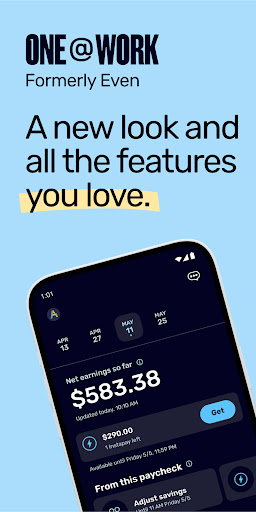

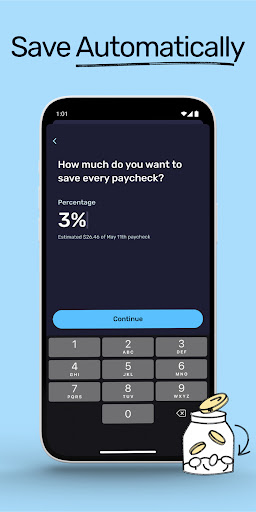

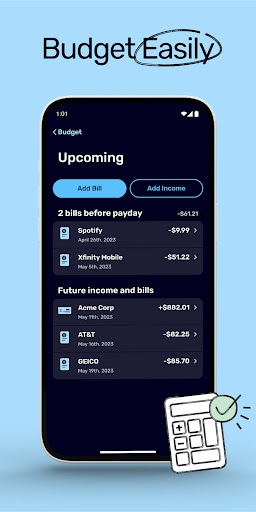

The ONE@Work app, formerly known as Even, is designed to help users manage their finances efficiently with an easy-to-use mobile app. It provides features like automatic savings, expense tracking, and bill payments to improve your financial stability.

Is the ONE@Work mobile app safe to use?

Yes, the ONE@Work app takes user safety seriously by implementing secure data encryption and privacy measures. You can trust this Android app to securely handle your financial information and provide a safe app experience.

How do I install the ONE@Work Android app?

Installing the ONE@Work Android app is straightforward. You can find it on the Google Play Store, usually under the category of finance or banking apps. Follow the prompts to set up your account and start using its app features.

Can I access the ONE@Work app offline?

The app features include some offline capabilities, such as viewing your saved financial data. However, for real-time updates and transactions, an internet connection is necessary to ensure the best app experience.

What are the key app features of ONE@Work?

This finance app offers a variety of features, including automatic savings, expense categorization, bill reminders, and budgeting tools. These features make it a comprehensive app based solution for managing your money efficiently.

Is the ONE@Work app suitable as a launcher app on my mobile device?

While ONE@Work is primarily a finance app, it may be set as a launcher app if it offers quick access to financial tools or widgets. Usually, it functions best as a dedicated app for managing your financial tasks.

Does the app regularly update its versions for better performance?

Yes, the developers of ONE@Work frequently update the app to enhance performance, add new app features, and ensure security. Keeping your Android app up to date helps provide a smoother, more reliable app experience.

Is there customer support available if I face issues with the app?

Absolutely, the app provides customer support through in-app help centers or official contact channels. You can rely on this app-based solution to address concerns promptly and maintain your trust in its reliability.

Venmo

Finance 4.9

Investing.com: Stock Market

Finance 4.6

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Capital One Mobile

Finance 4.5

TrueMoney

Finance 3.4

Revolut: Spend, Save, Trade

Finance 4.7

Intuit Credit Karma

Finance 4.8

Credit Sesame: Grow your score

Finance 4.7

MoneyLion: Bank & Earn Rewards

Finance 4.6

Green Dot - Mobile Banking

Finance 3.6