- Developer

- Jpay Mobile

- Version

- 25.3.0

- Content Rating

- Everyone

- Installs

- 5.00M

- Price

- Free

- Ratings

- 4

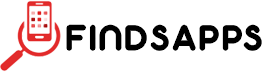

Core Features

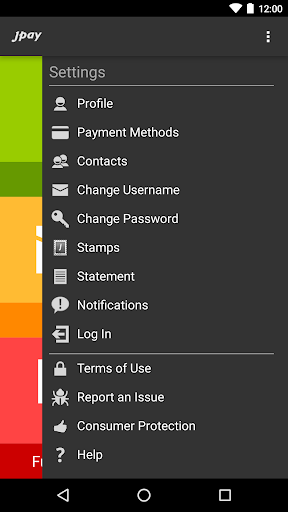

- The app features secure login and identity verification, ensuring user data is protected at all times.

- Real-time transaction tracking allows users to monitor their financial activity instantly and accurately.

- Many app features support quick bill payments, making financial management convenient and straightforward.

- This mobile app offers seamless integration with bank accounts and other financial instruments for easy access.

- Offline mode enables users to access transaction history and perform certain actions without an internet connection.

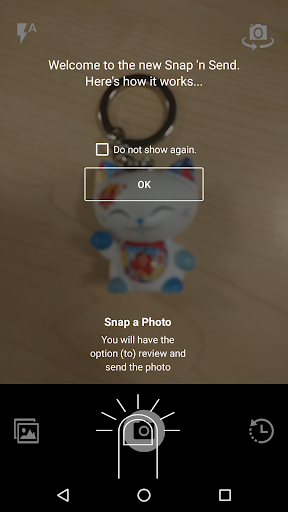

- Intuitive interface design simplifies navigation, providing a better app experience for all users.

- Push notifications keep users updated on transaction status and important account alerts.

- The app functions as a reliable launcher app for quick access to frequently used finance tools and services.

Who This App Is For

This mobile app is designed for individuals who need a trustworthy solution to manage their finances on the go, including busy professionals and students.

It benefits those looking for a straightforward app experience to handle bill payments, track expenses, and stay updated on their financial status using an efficient app-based solution.

Why Choose This App

This Android app combines essential app features with a user-friendly design, making it easy for anyone to manage finances securely.

Its reliable app experience and comprehensive features set it apart from other finance apps, delivering real value to users seeking a trusted app-based solution for their needs.

JPay

Finance 4Pros

- User-Friendly Interface

- Secure Payment Options

- Fast Transaction Processing

- Wide Range of Services

- Reliable Customer Support

Cons

- App Stability Issues (impact: medium)

- Limited International Support (impact: medium)

- Occasional Payment Delays (impact: medium)

- Interface Customization Constraints (impact: low)

- In-app Advertising Clutter (impact: low)

Frequently Asked Questions

Is the JPay app safe to use?

Yes, the JPay mobile app is designed with user security in mind. It uses encryption and secure login methods to protect your personal and financial information, making it a trustworthy app for managing transactions.

As with any app, ensure you're downloading it from official sources like Google Play or the Apple App Store. This helps guarantee you're getting a genuine version that adheres to safety standards, which is essential for a smooth app experience.

How do I create an account on the JPay app?

Setting up an account on this mobile app is straightforward. Simply open the JPay app and follow the on-screen instructions to register using your personal details. Once registered, you'll be able to access all app features easily.

If you're new to JPay, you'll need to verify your identity with one of the supported methods, which ensures secure access. Overall, the process is user-friendly for anyone familiar with standard app registration procedures.

What are the key features of the JPay app?

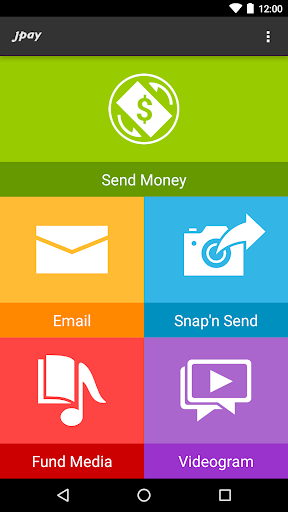

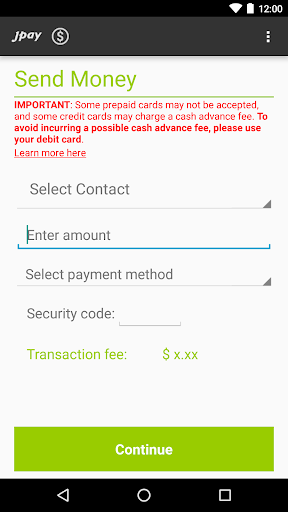

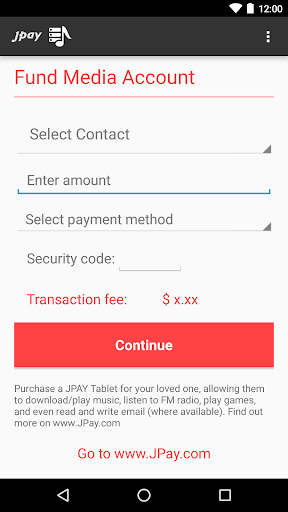

The JPay app offers a range of useful app features tailored for users needing quick and easy financial transactions. You can send money, buy stamps, and manage prepaid accounts directly from your mobile device.

This app based solution simplifies managing your payments without visiting a physical location. Its intuitive interface enhances the overall app experience, making routine transactions hassle-free on your Android device.

Can I use JPay on both Android and iPhone devices?

Yes, the JPay mobile app is available for both Android and iPhone users. Downloading the app on either platform provides access to the same app features and a consistent app experience across devices.

While the app is optimized for Android, it also functions well on iOS, ensuring you can manage your financial transactions conveniently whether you're on an Android mobile app or an iPhone. This cross-platform accessibility enhances the overall user convenience.

What should I do if I forget my login details?

If you forget your login username or password for the JPay app, use the 'Forgot Password' option available on the login screen. This process helps you reset your credentials securely.

Remember to use your registered email address or other identity verification methods to regain access. Restoring your login is simple and keeps your app experience smooth and protected.

Is the JPay app compatible with all Android devices?

The JPay Android app is designed to work on most modern Android devices. However, compatibility depends on the device's OS version and hardware specifications.

If you're experiencing trouble installing or running the app, check that your device meets the minimum requirements listed in the app store. Ensuring compatibility helps provide a seamless app experience for users across different Android phones and tablets.

Are there any fees associated with using JPay?

While the JPay app facilitates many transactions, there may be applicable fees for certain services, like money transfers or purchasing stamps. These fees are usually disclosed during the transaction process.

Understanding the fee structure beforehand helps in planning your transactions better. The app features are transparent about costs, which builds trust and makes it a reliable app-based solution for managing finances.

How often is the JPay app updated?

The developers regularly update the JPay mobile app to improve functionality, security, and user experience. Keeping your app current ensures access to the latest features and fixes for any issues that arise.

Updates are available through the Google Play Store or Apple App Store and are crucial for maintaining a trustworthy app experience. Staying current with updates guarantees your app remains compatible with your device and safe to use.

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Capital One Mobile

Finance 4.5

TrueMoney

Finance 3.4

Revolut: Spend, Save, Trade

Finance 4.7

Intuit Credit Karma

Finance 4.8

Venmo

Finance 4.9

Investing.com: Stock Market

Finance 4.6

Green Dot - Mobile Banking

Finance 3.6

Uphold: Buy BTC, ETH and 300+

Finance 4.5

Albert: Budgeting and Banking

Finance 4.6