- Developer

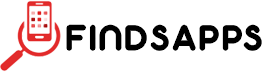

- Chime

- Version

- 5.305.0

- Content Rating

- Everyone

- Installs

- 10.00M

- Price

- Free

- Ratings

- 4.8

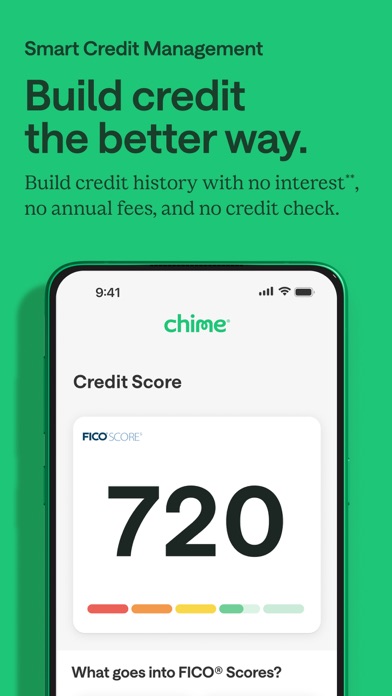

Core Features

- The app features robust account management tools that allow users to easily monitor their balances and transaction history in real time.

- It includes seamless fund transfer options with instant processing, making payments quick and hassle-free.

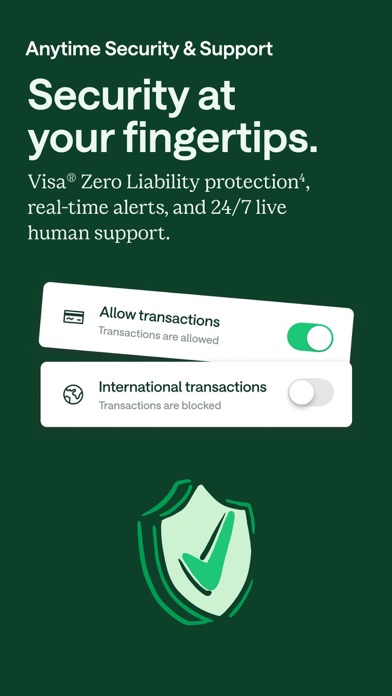

- With security being a top priority, the app offers biometric login and fraud detection for safe banking experiences.

- App features also include bill payments and mobile check deposits, providing comprehensive financial management from one platform.

- This mobile app integrates with your device's notifications for real-time alerts about account activity and offers an intuitive user interface.

- Designed as an app-based solution, it supports on-the-go banking, perfect for busy lifestyles needing quick access to finances.

Who This App Is For

This mobile banking app is ideal for tech-savvy adults aged 18-45 who prefer managing their finances through their smartphones.

It suits users who seek a reliable app experience for everyday banking, payments, and account oversight, especially on Android app devices or as a launcher app for quick access to financial tools.

Why Choose This App

This Android app stands out by offering comprehensive app features that prioritize security and convenience, making daily financial tasks simple.

Its app-based solution ensures you can handle banking needs anytime, anywhere, with an interface designed for clarity and ease of use, setting it apart from the competition.

Chime – Mobile Banking

Finance 4.8Ratings:

Downloads:

Age:

Pros

- User-Friendly Interface

- No Monthly Fees

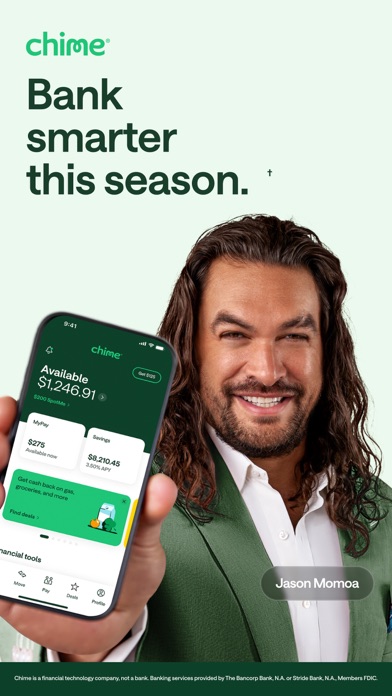

- Early Direct Deposit

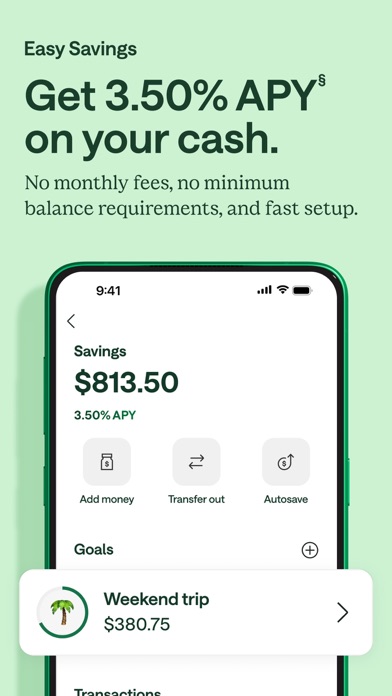

- Automatic Savings Features

- Robust Security Measures

Cons

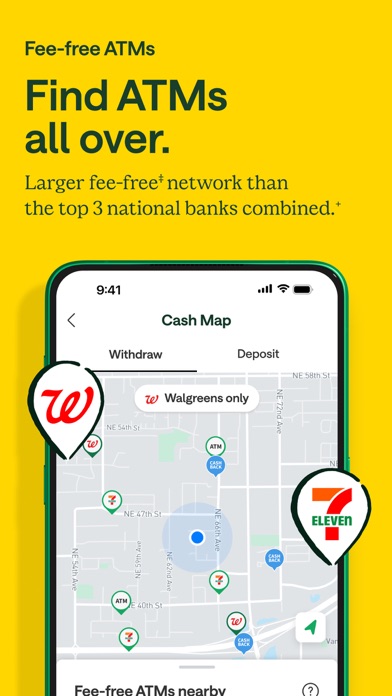

- Limited ATM Network (impact: Medium)

- No Physical Branches (impact: Low)

- Customer Support Wait Times (impact: Medium)

- Delayed Fund Transfers to Other Banks (impact: Low)

- Limited Investment Options (impact: Low)

Frequently Asked Questions

How do I log into the Chime mobile app on my phone?

Logging into the Chime mobile app is straightforward. Just open the app, enter your registered email or phone number, and input your password. If you're new, you'll need to sign up first. Once logged in, you'll access your account dashboard where you can view balances, transfer funds, and manage your app features. The app experience is designed to be simple and secure, making banking on your mobile device easy and safe.

Is the Chime app safe to use on Android devices?

Yes, Chime is a highly trusted mobile app that prioritizes user safety with advanced security measures. It uses encryption and secure login protocols to protect your personal information. Many users rely on this app based solution for everyday banking needs, knowing their data is well guarded. It's compatible with Android and operates smoothly on most devices, providing peace of mind during your app experience.

What features does the Chime mobile banking app offer?

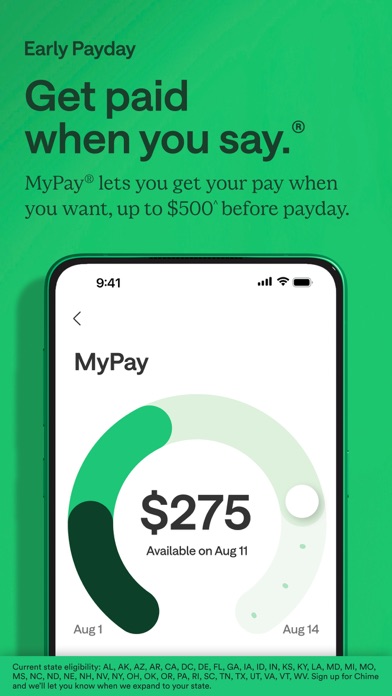

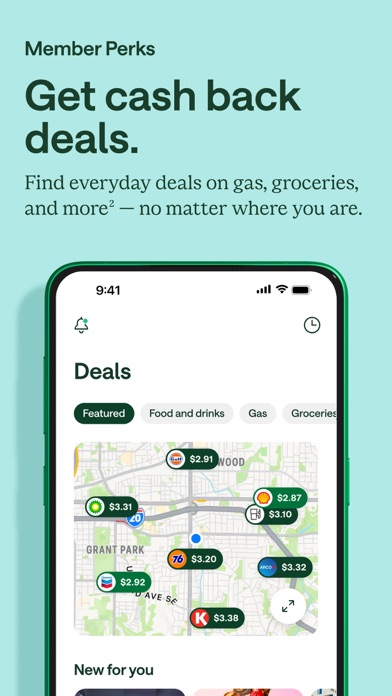

Chime's app features include instant transaction alerts, early paycheck access, and no overdraft fees. It also offers a handy spending account with a linked Visa debit card and automatic savings options. This app based solution simplifies money management by combining essential banking functions into a single, easy-to-use mobile app, making your financial life more organized and accessible anytime.

Can I use Chime as a launcher app for my daily banking needs?

While Chime functions as a complete mobile banking app, it doesn't serve as a launcher app in the traditional sense. However, it provides quick access to your finances directly from your phone's home screen. With a seamless app experience, you can easily check your account, transfer funds, or review transactions, making it feel like a personalized launcher app tailored to your banking activities.

What should I do if I forget my login details for the app?

If you forget your login info, Chime's mobile app provides a simple recovery process. Just tap on the 'Forgot password' option and follow the prompts to reset your credentials. This ensures your app experience remains secure and accessible, giving you confidence in managing your funds securely on this trusted app based solution.

Is the Chime app compatible with all Android versions?

Chime's Android app is designed to work on most recent Android versions, ensuring a wider audience can access its features without issues. For optimal experience, it's recommended to use the latest version available for your device. The app's compatibility ensures that users enjoy a smooth, reliable app experience, regardless of whether they're new to mobile banking or seasoned users.

How does Chime ensure the safety of my financial data?

Chime employs multiple security measures, including encryption, secure login, and real-time monitoring, to protect your financial data. Your privacy is a top priority with this app based solution. You can trust that your app experience is backed by a reputable service that takes user safety seriously, making it a reliable choice for managing your finances on your mobile app.

Revolut: Spend, Save, Trade

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Capital One Mobile

Finance 4.9

Walmart MoneyCard

Finance 4.1

JPay

Finance 4

Fidelity Investments

Finance 4.3