- Developer

- Bright Money

- Version

- 1.58.3

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.6

About Bright Money - AI Debt Manager

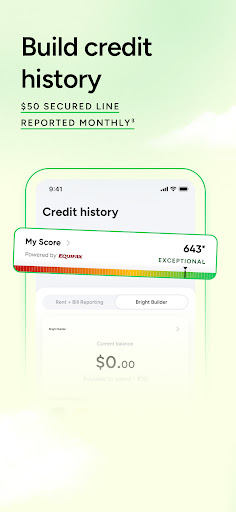

Bright Money - AI Debt Manager is a user-friendly mobile app designed to help individuals manage and reduce their debts efficiently. As an Android app, it offers a personalized app-based solution that combines intelligent algorithms with real-time insights, making the debt repayment journey clearer and more manageable. Its clean interface and expert-backed features enhance the overall app experience, providing users with dependable tools to regain financial control.

Core Features

- The app features a comprehensive dashboard that provides an overview of your debt and spending patterns in real-time.

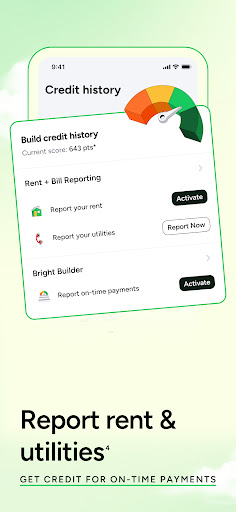

- Auto-payment reminders help users stay on top of their bills, reducing late fees and improving credit scores.

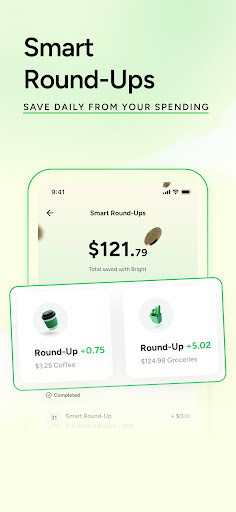

- Personalized budgeting tools enable users to set financial goals and track progress effortlessly within the app experience.

- The app includes a debt payoff planner that suggests strategies tailored to your financial situation with app-based solutions.

- Secure bank account linking allows for seamless synchronization and real-time expense tracking.

- Financial insights and tips are provided based on your spending habits, enhancing financial literacy.

Who This App Is For

This mobile app is ideal for adults of all ages who want to manage their finances more effectively. It appeals to those new to budgeting as well as experienced users seeking smarter debt management tools.

It's especially useful for individuals actively working to pay down debt or improve their credit score, offering practical app features for everyday financial decisions in a straightforward way.

Why Choose This App

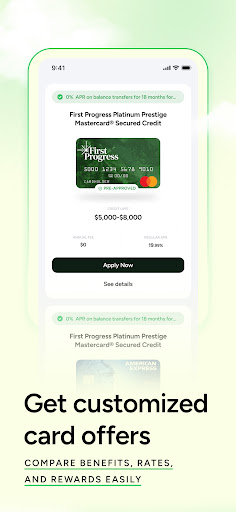

This Android app stands out by combining user-friendly design with powerful app features that simplify debt management. Its app-based solution offers real-time insights, making financial health easier to monitor and improve.

With a focus on reliable app experience and trusted functionality, Bright Money provides a smarter way to handle personal finances, setting it apart from less intuitive alternatives in the finance category.

Bright Money - AI Debt Manager

Finance 4.6Ratings:

Downloads:

Age:

Pros

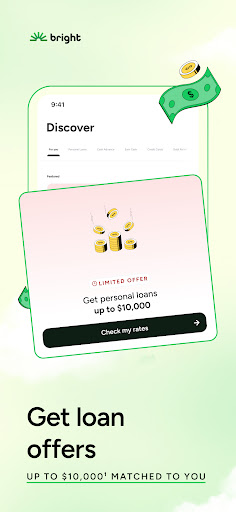

- AI-driven Debt Optimization

- User-Friendly Interface

- Real-Time Monitoring

- Automatic Payments Integration

- Holistic Financial Planning

Cons

- Limited Credit Card Support (impact: medium)

- Premium Features Require Subscription (impact: low)

- Initial Setup Can Be Time-Consuming (impact: medium)

- Occasional Data Sync Delays (impact: low)

- Limited Educational Resources (impact: low)

Frequently Asked Questions

Is the Bright Money - AI Debt Manager app safe to use?

Yes, Bright Money is a secure app that prioritizes your privacy and data safety. It follows industry standards to ensure your financial information remains protected when you use this mobile app.

As an experienced finance app, Bright Money uses encryption and secure login methods, making it a trustworthy app-based solution for managing debt and financial goals effectively.

How do I get started with Bright Money - AI Debt Manager on my Android device?

Getting started with this Android app is straightforward. Simply install the app from the Google Play Store, create an account, and follow the guided onboarding process to set up your financial profile easily.

The app features an intuitive user interface, ensuring a smooth app experience. It's designed to help you manage your finances efficiently from your launcher app or directly through the app itself.

Can I use Bright Money without an internet connection?

While many features of Bright Money are optimized for online use, certain app features may require an internet connection for real-time updates or syncing data. However, basic account access might be available offline.

This app-based solution aims to provide flexibility so you can stay on top of your debt management even when you're offline, but for the full app experience, connecting to the internet is recommended.

Does Bright Money offer personalized financial advice?

Absolutely. Bright Money leverages AI technology to analyze your financial data and offer tailored suggestions. This helps you develop a customized plan to tackle debt and improve your overall financial health.

Such app features make this mobile app a practical tool for those seeking an experience that adapts to individual needs, making it a reliable app-based solution for managing personal finances effectively.

What are the main app features of Bright Money?

This finance app includes features like automatic debt tracking, budgeting tools, personalized savings plans, and real-time financial insights. Its user-friendly interface makes it easy to monitor your progress.

Designed for a seamless app experience, Bright Money combines robust tools with an intuitive layout, making it a valuable app for anyone looking to stay on top of their financial goals using a trusted app-based solution.

Similar Apps

Revolut: Spend, Save, Trade

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Capital One Mobile

Finance 4.9

Walmart MoneyCard

Finance 4.1

JPay

Finance 4

Fidelity Investments

Finance 4.3